As candidates for the U.S. presidency pitch policies they hope will win them the White House, two leading Yale scholars suggest they ought to consider the hard work and nitty-gritty politics of coalition building that has accompanied all successful major reforms, from the abolition of the slave trade to the establishment of Social Security and Medicare.

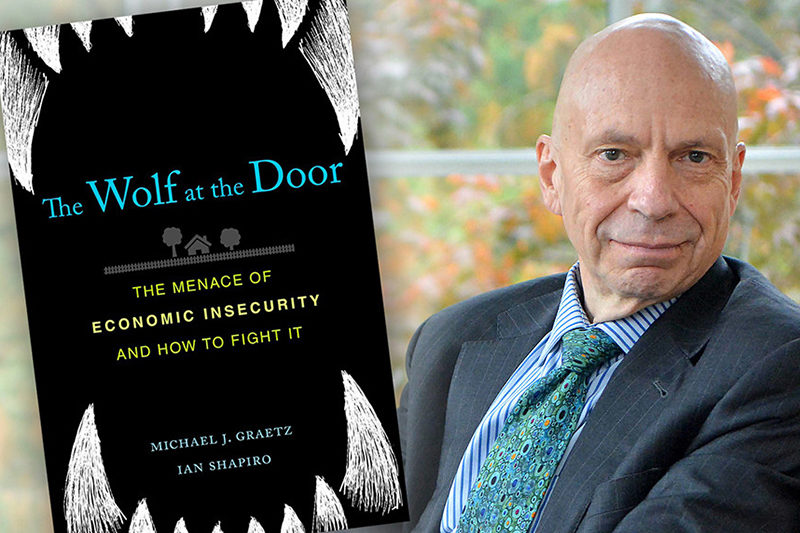

In their new book, “The Wolf at the Door: The Menace of Economic Insecurity and How to Fight It” (Harvard University Press), Ian Shapiro, Sterling Professor of Political Science, and his co-author, Michael J. Graetz, the Justus S. Hotchkiss Professor Emeritus at the Yale Law School, lay out detailed proposals for achievable reforms that, they argue, will make Americans more economically secure.

Emphasizing the need to forge coalitions around realistic goals, the scholars’ recommendations include measures intended to increase job opportunities, improve wages, and provide Americans better health care.

Shapiro recently spoke to Yale News about the book.

Why prioritize economic insecurity over economic inequality?

There are several reasons. The first is that economic insecurity is rampant in the United States. About 40% of Americans say they couldn’t cover an unexpected $400 emergency expense with cash or a credit card charge they could pay off at the end of the month. Unless this insecurity is addressed, our politics will become increasingly ugly. You’ll see increased polarization and anti-immigration sentiment.

Second, as we learned from Daniel Kahneman and Amos Tversky’s critique of conventional economics, the prospect of loss is a more potent political motivator than the prospect of gain. Trump’s slogan “Make America Great Again” was effective because it implies that he would restore something that was taken away. It wasn’t about addressing inequality. He didn’t promise to make people rich or redistribute wealth. In fact, he bragged about his own wealth. Two-thirds of Trump’s primary voters earned above the U.S. median income of $50,000 for a family of four. These are not blue-collar folks, but they fear that they’re losing things. They’re worried about downward mobility — that their kids will be less successful than they are.

This is not to say that people don’t care at all about what others are earning. But the social science evidence is that they tend to make fairly local comparisons — to people in similar industries and professions. A professor will be much more aggrieved to learn that she earns $10,000 less than a similarly qualified professor in the next office than to learn that she makes $500,000 less than the attorney who lives next door.

What incentives does the business community have to address economic insecurity?

We argue, again, that fear is the best motivator. In the wake of the Great Depression, the country had high levels of unemployment; there was an alternative in the Soviet model competing for the hearts and minds of American workers, and communists had significant influence in sectors of the American labor movement. There were good reasons to ensure that America was not creating a world in which workers might really come to believe they had nothing to lose but their chains. Once the Cold War ended and capitalism became the only game in town, I think business leaders and other members of the political and economic elites became complacent. They did not see the economic insecurity that has come to pervade much of the workforce as their problem.

Today we live in a world in which 18-year-olds can expect to change jobs more than a dozen times over their working years. That can be an appealing scenario for those on the right side of the technological revolution, but it is a terrifying prospect for tens of millions of Americans.

The current political climate in the United States and Europe is giving business leaders a reason to think that maybe they need to address economic insecurity. If they let it fester, then they’re going to confront a lot of policies they dislike, such as trade protectionism and anti-immigration policies. That’s the stick. The carrot is that business needs a well-educated workforce with the skills and capacity to meet the economy’s changing needs. Business leaders have an interest in helping create the kind of workforce that they are going to want to employ.

What is your proposal for creating that workforce?

Every other advanced economy spends notably more than the United States on helping unemployed workers reenter the workforce. Germany and France spend five times as much. Denmark pours enormous resources — more than 2% of its GDP — into retraining workers. The United States has a spotty record on this. There have been missed opportunities that we describe in our book. The time for major innovation on this front is now.

One of our proposals is to create what we call Universal Adjustment Assistance, which would provide adequate unemployment coverage and benefits for any worker who loses a job without fault and is actively seeking employment. It would include increased spending on job training and provide assistance to workers and their families who need to relocate to take a new job.

Higher wages would reduce insecurity. How do you propose increasing people’s income?

We recommend a significant expansion of the earned income tax credit (EITC) by both the federal and state governments. The EITC is a refundable tax credit available to low and moderate-income workers. The amount of the credit depends on a worker’s income and the number of children they claim as dependents.

It’s a way to subsidize wages that goes directly to workers. The approach deployed by the Trump Administration in the Tax Cuts and Jobs Act of 2017 was to tell businesses they’ll get tax breaks so that they can invest in their workforces. As we’ve seen, the investment in workers doesn’t necessarily happen; the savings can just as easily be spent on stock buybacks and increased dividends to shareholders. By directly subsidizing people’s wages, EITC programs give businesses a positive incentive to hire people.

Improving the healthcare system seems essential to strengthening people’s economic security. Why has galvanizing support for a single-payer health system proved so challenging?

The country’s partial successes in healthcare have made moving to a universal system more difficult. During World War II, employers dealt with wage freezes at the time of a labor shortage by offering employees benefits like health insurance. That caused a big expansion of employer-provided health insurance. In 1965, the Johnson Administration enacted Medicare, which is single-payer health insurance for people aged 65 and older. It’s hugely popular and politically bulletproof.

As a result, today we have 180 million people with private health insurance and everyone 65 and over enrolled in Medicare. How do you create a coalition to push for universal health insurance when so many are already covered? A lot of people with employer-provided coverage don’t have a strong incentive to support change. The elderly already have coverage and might worry that a universal system would dilute their benefits. On top of this, the insurance companies will bitterly oppose any proposed universal system. And, young people won’t mobilize for universal coverage because they tend to think they won’t get sick. It all adds up to a huge challenge.

How do you propose overcoming those obstacles?

Our proposal would create a public option and subsidize it at the bottom of the age cohort, where it will be cheap because young people just tend to be healthy. Most people can get insurance up to age 26 on their parents’ policies under Obamacare, so we would start with 26 to 30 year olds, who could buy coverage through the public option cheaply. Then they would keep it. Over time, a coalition builds because once people have coverage through the public option they’ll want to keep it. Moreover, many people with employer-provided coverage will lose their jobs multiple times in the employment markets of the future, and their new jobs might or might not include coverage — or adequate coverage.

Some unions are hostile to universal health care because their members are covered in hard-won collective bargaining agreements. But because medical inflation is substantially above the inflation in the rest of the economy due to inefficiencies in our present system, this puts great pressure on employers to hold down wages and to cut back on what the plans cover. This will make it increasingly difficult for unions to protect the workers with employer-based coverage, and because the great majority of workers are not unionized in today’s economy, many plans will deteriorate to the point where the workers will want an alternative. They’ll have growing incentives to choose the public option. This way, you gradually build a strong coalition.

That’s a good illustration of how we approach all of these problems in the book. People lament that the United States is the only wealthy country that doesn’t have universal health insurance, but they don’t consider how we reached this point. You need to identify the source of the problem and then do the hard work of building a coalition to address it. That’s the essence of the book.